There are over 200,000 gyms and fitness franchises worldwide with thousands of individual franchise owners.

So gyms must be good investments, right?

We were wondering the same, so, in this article, we asked “What if you had $100,000 to invest into gym ownership? Is a gym a good investment?”

Gyms can be very good investments as compared to other investments. Here’s how an investment into a gym compares:

- A 10-Year Treasury Bond, known as the risk-free rate, currently earns about 3%

- Real estate earns about 10% per year

- Historically, the S&P 500 earns 10.5% per year

- A gym and fitness franchise averages about 15%

Would a gym be a good investment? How would you know that you made a good investment?

We did some research and spoke with a few real gym owners and this is what we found out.

What is a Good Investment vs a Gym Investment?

Technically, any investment that positively cash flows or has a positive return can be said to be a “good” investment.

By this definition, fitness franchises are good investments, as are most other things that return capital invested.

But, we do want to stop there.

We believe in gyms and fitness franchises and believe they are great investments for investors and can hold their own against other asset classes in terms of both return and cash flow.

So, we dove deeper into this question.

Let’s start by defining what a good investment is. A “good” investment is one that matches, or beats, other investments when measured by return.

For example, if Stock A returns 5% per year and Stock B returns 10% per year, we will say that Stock B is better than Stock A and is a “good” investment.

Side note: In reality both Stock A and Stock B may be good investments, but since capital goes where it’s treated best, we will stick with our initial definition.

For the purposes of this article, we will be comparing individual fitness franchise locations to real estate investments, the 10 year US treasury bond, and the average stock market return (measured by the S&P 500).

How Does a Gym and Fitness Franchise Investment Measure up against the Treasury Bond, S&P 500 and Real Estate?

Now that we have defined what other investments fitness franchises will be compared against, let’s see how they stack up.

10 Year Treasury Bond

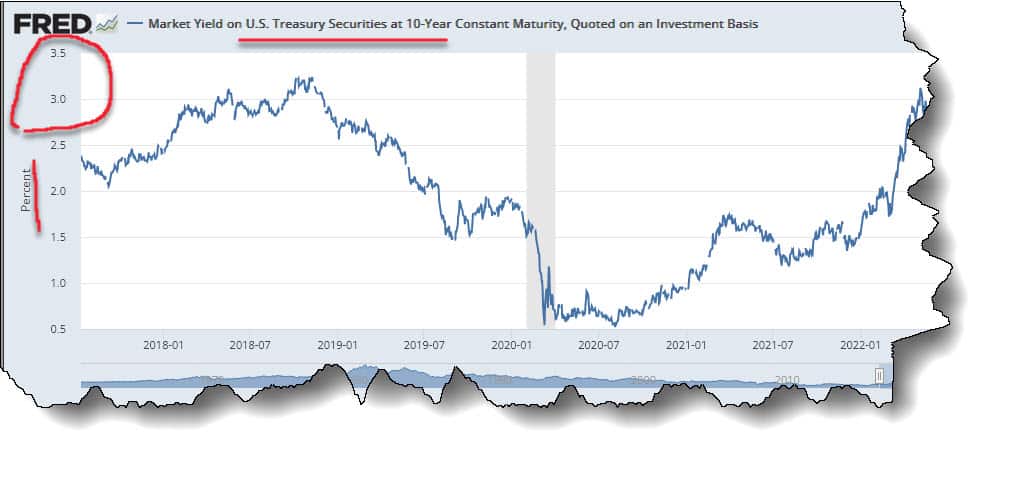

The yield on the 10 year US treasury bond is also referred to as the “risk-free rate”. This is because the US government backs these completely and there is no risk to investors who buy them. As any investor will tell you, high risk can yield high return, but the inverse is true too, low risk equals low return. At time of writing, the yield on a US treasury bond is around 3%. This means that you will earn a 3% return on your money year over year while holding this bond.

So, an investment of $100,000 in to a US treasury bond will give a yearly return of $3,000 or 3%.

S&P 500

The Standard & Poor’s 500, or S&P 500, is a stock market index that tracks 500 of the largest publicly traded US companies. The S&P 500 is so large and encompasses so many companies that it is commonly referred to as the “market index”. This means that the return of the S&P 500 is a suitable measure for the return of the entire stock market.

Per Investopedia, the average yearly return of the S&P 500 is 10.5%. This means that a $100,000 in to the S&P 500 would yield $10,500 per year.

Real Estate

Real Estate has long been touted as the easiest and quickest way to become wealthy due to its regular price appreciation and high income potential. There are many different ways to invest in real estate from residential homes to office space to farmland and everything in-between. Real estate returns are heavily affected by location, type of property, age of the property, the size of the property, and its primary use. With so many options, it is difficult to nail down an exact return on real estate investments.

Per the National Council of Real Estate Invest Fiduciaries (NCREIF), the average return on investment real estate is 10% per year. This means that a $100,000 investment in real estate will yield $10,000 per year.

Gyms and Fitness Franchises

Last on this list is gyms and fitness franchises. Much like real estate investment, it is hard to nail down an exact return figure on gyms and fitness franchise investments.

Returns are heavily affected by management, location and what company or brand owns the gym or franchise and the financing structure.

For example, to find the average return of fitness franchises in the US, we took the average sales revenue of an individual franchise minus the average cost of opening a franchise divided by the average cost of opening a franchised location and turned that into a percentage of some of the largest fitness franchises in the US.

All of this information comes from 2021 FDD filings for the franchises listed and here are the results:

| Franchise Name | Sales Revenue | Cost to Open | Return |

| Anytime Fitness | $441,116.03 | $381,054 | 15.76% |

| D1 Training | $620,261 | $452,770 | 37% |

| Fitness Premier | $541,453.57 | $427,674 | 26.6% |

| Planet Fitness | $1,741,000 | $2,161,300 | -19.45% |

| Average | 14.98% |

Example: Anytime Fitness

(441,116.03 – 381,054)/ 381,054 = (60,062.03)/ 381,054 = 15.76%

With an average return of 14.98% per year, $100,000 invested into a fitness franchise would return $14,980 per year.

While this isn’t exactly the perfect method for measuring investments, it does provide a framework for further discussion and exploration.

Conclusion

In the right scenarios, not only can the ownership of a gym and fitness franchise stand up against other common investments, it’s quite possible to beat other investments when measuring average returns.

While investing into a gym or fitness franchise is not for every investor, potentially high returns and regular cash flow justifies a solid consideration.

Of course this article is not investment advice and the revenues, expenses, and returns listed here are averages and not guarantees.

Want to learn more about fitness franchises and how you can invest in them or own your own? Check out FitnessFranchiseInfo.com!